Back after a long break. Thanks to all those who insisted that content here is worth reading.

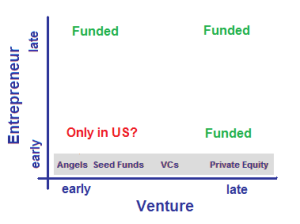

Early stage VCs in India invest in early stage ventures BUT those started by late stage entrepreneurs. If you are a young, first time entrepreneur with no track record, fire in the belly and a great idea – tough luck. This seems not limited to India since recently I met someone who emigrated to Silicon Valley from Singapore due to this problem.

So,

early stage company + experienced entrepreneur = FUNDING

late stage company + experienced entrepreneur = FUNDING

late stage company + rookie entrepreneur = FUNDING

early stage company + rookie entrepreneur = ?

Alternatively,

I think this is just the lifecycle of startup funding in India and nothing much can be done about it right now. At current risk appetite in India, people bet money on trust which derives from track record. Now either the track record is in the company or the person or in the reference. The ideal reference comes from another funded entrepreneur who would typical reserve it for employees whom he has seen first hand. If funded entrepreneurs in India are less, ex-employees looking to start up even lessor. And angels who are (ex)entrepreneurs even rarer. It just takes time for this ecosystem to setup!

I think the current generation of entrepreneurs will turn angels in 10-15 years and provide the critical mass to fill the early stage funding gap in India. Finally figured out the early stage VCs in India. It also reminded me again that the only credible alternative for young entrepreneurs without access to capital is to bootstrap (which as I have said earlier is not the best way to start but surely the next best).